Our Mortgage Broker Vs Loan Officer PDFs

Wiki Article

How Mortgage Broker Salary can Save You Time, Stress, and Money.

Table of ContentsLittle Known Questions About Mortgage Broker.Mortgage Broker Job Description for BeginnersLittle Known Facts About Mortgage Broker Meaning.Some Of Broker Mortgage MeaningThe Best Strategy To Use For Broker Mortgage RatesThe Only Guide for Mortgage Broker SalaryFascination About Mortgage BrokerWhat Does Mortgage Broker Salary Mean?

It is necessary to be thorough when working with any type of professional, consisting of a home loan broker. Some brokers are driven exclusively to close as lots of loans as feasible, thus jeopardizing service and/or principles to seal each offer. A home loan broker will not have as much control over your funding as a huge bank that finances the finance in-house.One of one of the most complex components of the mortgage procedure can be finding out all the different kinds of loan providers that handle home mortgage as well as refinancing. There are direct lending institutions, retail lenders, home mortgage brokers, portfolio loan providers, correspondent lending institutions, wholesale lending institutions and others. Several customers just head right into the procedure and seek what seem practical terms without stressing over what sort of loan provider they're handling.

The smart Trick of Mortgage Broker Assistant That Nobody is Talking About

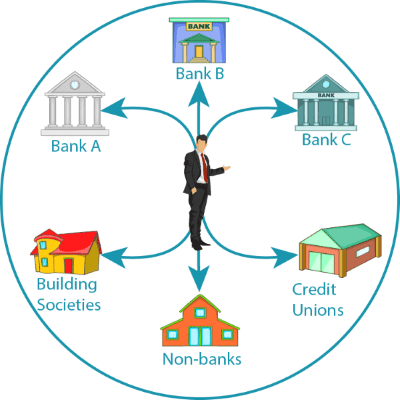

Descriptions of several of the major types are provided listed below. These are not necessarily equally unique - there is a fair quantity of overlap amongst the numerous groups. Many portfolio loan providers tend to be straight lenders. And many lending institutions are involved in even more than one type of lending - such as a big bank that has both wholesale and retail financing operations.Home loan Brokers An excellent place to begin is with the difference between home loan lending institutions and home loan brokers. Home loan lending institutions are precisely that, the lending institutions that actually make the loan and also provide the money used to get a house or re-finance a current home mortgage. They have specific requirements you need to meet in terms of creditworthiness as well as funds in order to receive a loan, as well as set their mortgage rates of interest as well as other funding terms as necessary.

The Basic Principles Of Mortgage Broker

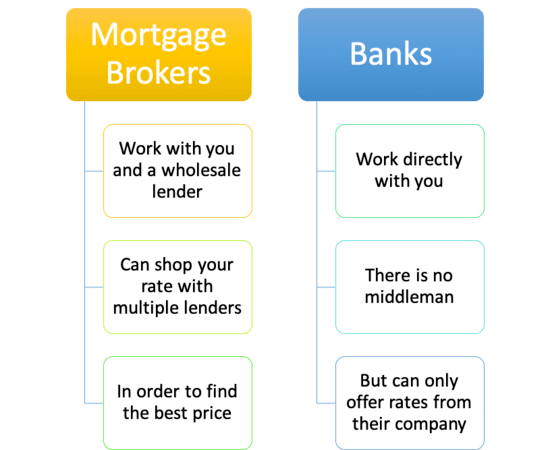

What they do is deal with several lending institutions to find the one that will use you the most effective rate as well as terms. When you take out the lending, you're borrowing from the lender, not the broker, who simply acts as a representative. Typically, these are wholesale loan providers (see below) who mark down the rates they use with brokers compared to what you 'd obtain if you approached them directly as a retail customer.Wholesale and Retail Lenders Wholesale lending institutions are banks or other institutions that do not deal straight with consumers, however provide their loans via third events such as home mortgage brokers, cooperative credit union, other financial institutions, etc. Typically, these are big banks that likewise have retail procedures that deal with consumers directly. Numerous large financial institutions, such as Bank of America and Wells Fargo, have both wholesale and also retail operations.

What Does Mortgage Broker Association Mean?

The crucial difference right here is that, rather than supplying lendings through middlemans, they offer cash to financial institutions or other home mortgage lenders with which to release their own loans, on their own terms. The stockroom lending institution is settled when the home loan lender sells the financing to investors. Home mortgage Bankers Another difference is in between portfolio lenders and also mortgage lenders.

The Ultimate Guide To Broker Mortgage Meaning

This makes portfolio loan providers a great choice for "specific niche" consumers that don't fit the common lending institution account - perhaps due to the fact that they're seeking a big financing, are thinking about a distinct residential or commercial property, have flawed debt but solid funds, or may be taking a look at financial investment residential property. You may pay higher prices for this solution, however not constantly - because profile lending institutions often tend to be very careful who they provide to, their prices are in some cases rather low.Tough money loan providers have a tendency to be personal individuals with cash to provide, though they may be established as service procedures. Rate of interest often tend to be fairly high - 12 percent is not uncommon - and down repayments might be 30 percent and also over. Tough cash lending institutions are normally used for short-term loans that are anticipated to be settled quickly, such as for investment property, instead of lasting amortizing finances for a house purchase.

The Broker Mortgage Near Me Diaries

Again, these terms are not constantly special, however instead typically define sorts of home mortgage functions that numerous loan providers may do, sometimes at the same time. Recognizing what each of these does can be an excellent aid in recognizing exactly how the home loan procedure jobs and also develop a basis for examining mortgage offers.discover here I am opened up! This is where the content goes.

Broker Mortgage Near Me for Beginners

Allow's dig deeper into this procedure: The initial step to take when acquiring a house in Australia is to obtain a declaration from the bank you are borrowing from, called pre-approval (please check this blog post to understand just how the pre-approval works in detail). To be able to do that, you first require to find a bank that settles on offering you the cash (mortgage broker average salary).

More About Mortgage Broker Association

Making use of a mortgage broker provides you lots of more options. Not only when it comes to best lending bargains, yet also for conserving time as well as staying clear of blunders that could get your lending refuted.

Report this wiki page